Think Space

Autor/izvor: DAZ 02/09/2015

Približava se 4. Think Space NeKonferencija, koja će se održati u Zagrebu 2. i 3. listopada, na kojoj ćemo ugostiti mnogobrojne, natjecatelje, predavače, žiratore i Think Space entuzijaste kroz niz diskusija, predavanja i izložbi. U sklopu najave, donosimo vam neke od prošlogodišnjih radova pristiglih na Think Space Call for Papers, koji se bave promišljanjem sprege arhitekture, novca i prostora u suvremenom svijetu.

Posebno izdanje programa Think Space, koje se ove godine realizira u sklopu projekta „Zagreb za mene“ se polako primiče svom finalu. Nedavno objavljenim rezultatima natječaja THINK public SPACE, na koji je pristiglo 73 rada iz 29 zemalja svijeta te evaluacijom radova pristiglih na Think Space Call for Papers pod temom „New publicness“, ulazimo u finale ovogodišnjeg posebnog izdanja programa. Ostvaren suradnjom s Gradom Zagrebom i Arhitektonskim fakultetom Sveučilišta u Zagrebu, program Think Space se ove godine bavio suvremenim poimanje i propitivanjem javnog i privatnog, javnih prostora, njihovih korištenja, programiranja te kreiranja i su-kreiranja.

Zadovoljstvo nam je vidjeti rast platforme suvremenih mislilaca u arhitekturi koje objedinjava Think Space, te se izrazito veselimo finalnom događaju ciklusa – Think Space NeKonferenciji, koja će se i ove godine održati u Zagrebu i to 2. i 3. listopada. Kao i uvijek, NeKonferencija će biti prigoda za okupljanje nagrađenih autora na aktualnom natječaju, razgovore i diskusije s članovima ocjenjivačkog suda te naravno dodjelu nagrada i izložbu pristiglih radova.

U sklopu priprema za NeKonfrenciju, u narednom periodu vam donosimo prošlogodišnje radove pristigle i evaluirane kroz Think Space Call for Papers, koji je ima temu MONEY / NOVAC. Radovi će biti dostupni ograničeno vrijeme, a kao što i sama tema govori bave se spregom novca i financija te suvremene arhitekture i gradova, kroz različite vidove interakcije. Danas pročitajte "Being Online: the infrastructure of money" Ive Baljkas.

Being Online: the infrastructure of money

Author: Iva Baljkas

Abstract

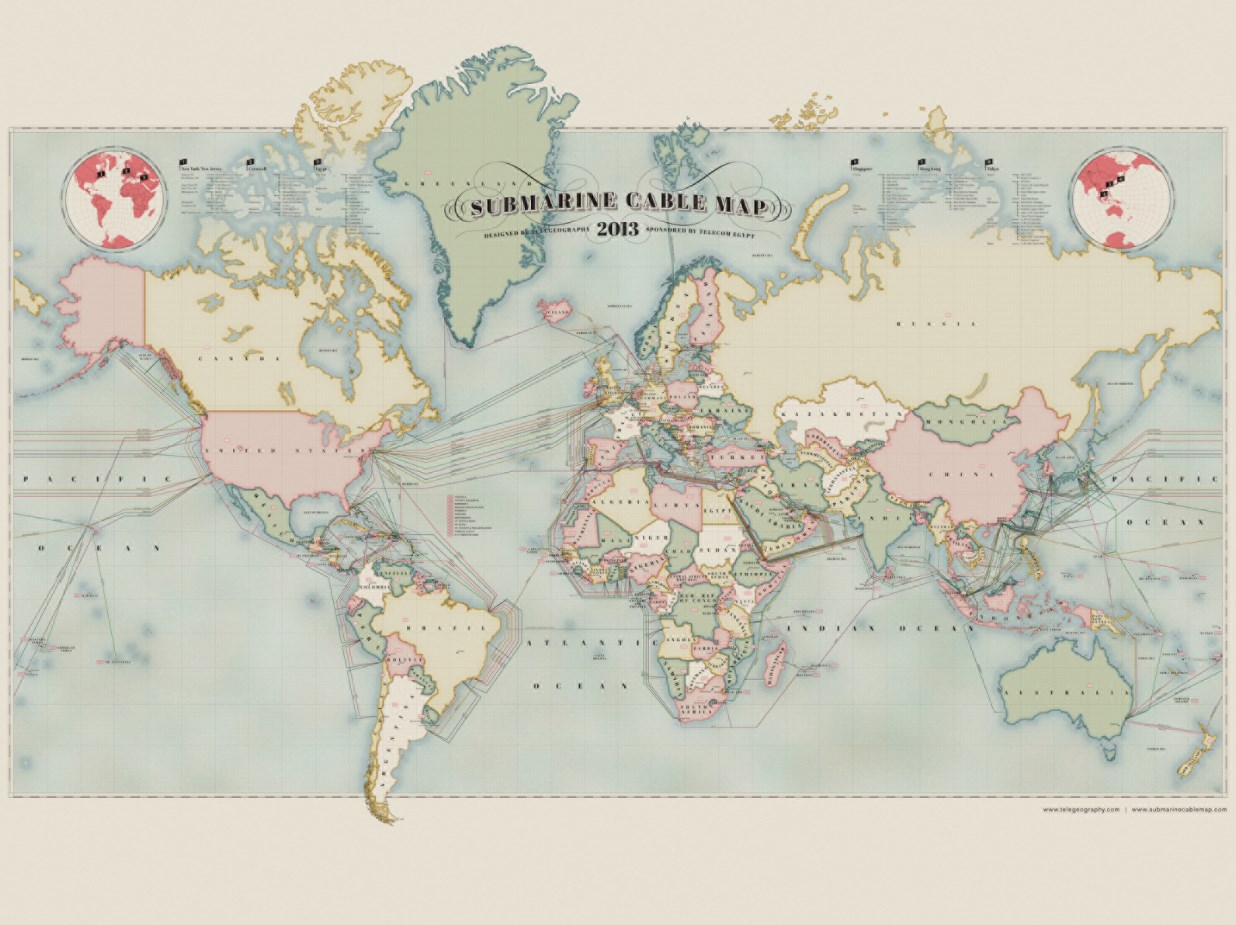

Money can be seen spatializing through the Internet cables and server farms around the world. Stock exchanges invest in placing cables throughout the world that directly connect them, avoiding any time delays in the system. Drawing the map of the world based on the Internet would be a completely different map as we know it. What kind of spaces do these infrastructures create? And could money be somehow ruled out of the picture?

This paper looks at the historical development of data centers in relationship to trade and tries to investigate how the space of currency exchange transformed from banks to server farms. (fig.1)

Introduction

'Time is still money in the world of high finance, but dollars are now measured in milliseconds.'[i]

The term infrastructure is simply defined as: 'the underlying foundation or basic framework (as of a system or organization)'.[ii] It began to be used around the time of 'Black Tuesday', one of the key events of the 1920's. The stock market crashed on October 29, 1929, as a result of the Economic boom that ended on that day, leading to the Great Depression.

Internet technologies are continously changing the face of the planet. Money can be seen spatializing through the Internet infrastructure, cables and server farms around the world. Drawing the map of the world based on the Internet would show differentiations in density of infrastructure which is intrinsically related to the economy.

An Internet Exchange Point is a physical infrastructure through which Internet Service Providers exchange Internet traffic between their networks. A closer look into networks and the Internet as a 'network of networks' demonstrates that Internet exchange points were developed, historically, so that different networks, carriers and Internet service providers can peer with one another for free. Internet Exchange Points reduce costs, enable higher bandwidth and provide the customers connected with less latency. Spatially, IXP's are spread throughout the world and there is a certain tendency to build more of the data centers facilities to support this process. These spaces operate based on two processes: latency and peering.

Peering is a mutual agreement between companies to exchange data without the fee. In a certain sense, this process can be compared to barter, a form of exchange between people before the currency was initiated, closely connected to space - using specific spots to exchange their goods and services. Peering is a voluntary interconnection of administratively separate Internet networks for the purpose of exchanging traffic between the customers of each network.

Latency in communications is a measure of time delay in the system, determined by the medium used. In a two way communication, latency can be seen as a limit of maximum amount of data that can be transmitted at a single moment. Low-latency is a crucial aspect in capital markets, where the speed of reaction of a company towards respective markets needs to be faster than the one being utilized by its competitor in order to increase profit.[iii]

As Bruce Mau explains one of the biggest changes of the 20th century is the fact that money turned 'digital':[iv]

'Built or grown by users, or in response to users, the new infrastructure consists of agreements, alliances, standards, and systems. It includes :

1. Mastercard, Visa, credit systems : In this vast e-commerce network, connection is more important than physcial real estate.

2. Currency exchange : Currency exchange is an overexpanding system of shifting values. Once a curency is posted, everything within its domain enters the realm of infrastructure....'

To facilitate digital trade in any form, from alghoritmic trading on the stockmarkets to transfering data from credit card to bank, one always uses the Network as infrastructure. Today money is not anymore a physical object but a virtual set of data. Stock exchanges invest in placing cables around the world that directly connect them to each other, to avoid any time delays in the system. Cities and their networks encapsulate all kinds of protocols of urban planning and emergent morphologies and the future development of cities is largely based on these infrastructures. It can be said that money today spatializies through data centers and internet cabels. What kind of spaces do these infrastructures create? (fig.2)

Cities and trade: Frankfurt, Los Angeles and New York

Frankfurt, Germany

Frankfurt is located at the heart of Germany, almost at the geographic centre of Europe. It has a long tradition of trade, from the 9th century onwards and has always been connected since its geographic location was at the crossing of historic trade routes and between two major rivers which were used as infrastructure for traffic.

Frankfurt is different from most European cities. Destroyed in the Second World War, it was almost entirely rebuilt, with the Downtown as one of its key landmarks. High rises in the centre can be regarded as objects whose physical size is produced by capital. Frankfurt is also home to the headquarters of the European Central Bank, with its new high rise currently being built. Ironically, the location is the old wholesales market, in close proximity to the riverfront and Osthafen, an old cargo harbour.

Frankfurt is also the home of De-Cix, Internet Exchange Point with the highest data transfer per second in the world.[v] Two territories and sites in Frankfurt have the densest accumulation of data centres, one in the West of the city and the other one towards the East. However, smaller data centres can be found in other locations around the city. Spatially, these locations are chosen so that they are close to neighbourhoods in which exchange and trade take place. The area in the West is close to the Bankenviertel and the one in the East is close to the new premises of the European Central Bank (ECB).

Most data centres in the city centre are retrofitted while the ones found on the outskirts are purpose built in the industrial areas creating a sort of an infrastructural enclave, a homogenous zone being produced by data centers and their non-architecture. In an interview Andrew Blum compares development of the Internet and urban fabric:

'The Internet is perhaps the greatest example ever of a human-made “emergent” system. There is no master plan. But the urban planning implications are difficult to consider. The Internet operates physically at multiple scales, which often collapse into each other: the machine, the building, the city, the region, and the globe. But it is also an incredibly complex thing in logical and algorithm terms. That makes it difficult to draw an analogy with urban planning. Cities are certainly multivalent—physical, economic, social—but in different ways."[vi]

Los Angeles, USA

The example used by Robert Summel and Kazys Varnelis in the book 'Blue Monday' is 'One Wilshire', a carrier hotel in the middle of downtown Los Angeles.[vii] Built in the 1960's and designed by Skidmore, Owings & Merill, 'One Wilshire' looks just like another office building. One of the key elements of the facade are windows designed to maximize light and views for the occupants. However, today's function of the building has no use of light and views. The building is 30 stories high and today houses mostly internet servers working as a key peering connection point. The proximity to the coast and cable landing stations enables a huge portion of American and European Internet traffic to run through the building.

Summel and Varnelis perceive it as a fountain of data, especially in the context of neighbouring buildings which were retrofitted to house telecom hotels, providing immediate proximity to the 'fountain'. The argument that the Internet and new technologies will in some sense undo cities as we know, can be argued with this example:

'Ironically, if one of the reasons for the downfall of the American downtown is the slowdown in transportation and wear on infrastructure created by congestion, the emptiness of the streets in Los Angeles's telecom district ensures that this will never again be a problem for this neighbourhood.'[viii]

The properties around 'One Wilshire' became valuable again, but remain uninhabited. They mostly house the infrastructure of the Network, without showing what is happening behind the form of the structure. Physical form becomes redundant; it is only there to give home to what we perceive as virtual. Internet exchange points are more feasible to participants connected, they strive to access the 'single point', so they can connect to other networks, internet service providers and carriers without charge. One of the key arguments in this sense is that laying optic fibre cables and ensuring their 'right of way' is expensive and 'requires significant negotiations'.[ix] That is the main reason why companies try to be as close as possible to the transmission source.

'One Wilshire' is also a key example of how carrier hotels, telecom hotels, data hotels, carrier neutral colocation[x] facilities, exchanges and switching stations can generally be found in the downtown area, usually located in the city's financial district close to stock markets and exchanges.

New York City, USA

In New York, data centres and internet facilities are dispersed within and around Manhattan. Nevertheless, one of them stands out: 60 Hudson Street.

In the 1920's, The Western Union Telegraph Company was searching for land to build their new headquarters in Lower Manhattan. Their spatial requirements were very strict: proximity to the New York Stock Exchange, the commodities exchanges, and also to the existing operations centre, with cable links spread out to the backcountry. In the following decade, messenger boys were spinning revolving doors all day, to more efficiently distribute messages to the trading firms of the Downtown New York.

60 Hudson Street is still an attractor, as most of the undersea transatlantic cables land there and therefore bring news from distant markets first. In today's financial services, especially the ones dealing with high speed algorithmic trading, milliseconds are the means of success. One can say the proximity that The Western Union Telegraph Company was looking for in the 1920's is still what is needed for markets to operate with low latency today. Most of the companies dealing with low latency trading today have clustered around 60 Hudson Street, situated in the TriBeCa neighbourhood of lower Manhattan, between Hudson, Thomas and Worth Streets and West Broadway. It was designed in the late 1930's by Ralph Walker as the headquarters of the Western Union Company. The design shows influences of German Expressionism and contains detailing known as Art Deco. The gradient of the facade is facilitated by 19 different colours of brick, from darker shades at the bottom to lighter ones at the top.

Up until 1973, the building housed offices, an auditorium, a cafeteria, a gymnasium, shops and equipment rooms and also classrooms for the messengers to further their education. 60 Hudson street then contained more than 21 million meters of cable. At the time of the telegraph, the Western Union Company was one of the leading centres of worldwide communications. In the 1970's, the building had been turned into a carrier hotel where over 100 telecommunication companies exchange internet traffic. It has once again become a prime site for worldwide communication networks.

The 'meet-me-room' on the 9th floor is powered by 10,000 Amp Dc power plant and has around 1'400 square meters. In this dark, not particularly attractive space, filled with different coloured wires, multiple local, national and global fibre optic cables interconnect. 2012 brings algorithmic trading to focus. The equipment was installed in the building close to 60 Hudson Street in order to conduct trades with low latency, so the trades are quicker than in Wall Street situated only a mile away. Today, 60 Hudson Street is one of the most important Internet hubs in the world, situated in one of the most vibrant cities in the world, at the heart of New York.[xi]

Economies of space

Most internet hubs are situated where dense algorithmic trading is taking place. The changes that happened from the mid 1990's till the beginning of the 2010's brought in different kinds of virtual spaces facilitating trade. Today, around 70 % of global trade is done by algorithmic trading. Stock exchanges and trading floors are usually found amongst the dense urban fabric of the city. Therefore, most of the data centers and Internet exchange points within city centres are retrofitted, due to the lack of space to build 'the new'. The density of inhabitants drastically changes, since data centers depending on size operate with a lot less workers than a typical office space found in the city center. Opposed to office spaces, stock exchanges and banks, where around 25 m2 facilitates one employee, data centers use around 3,000 m2 per employee. This huge discrepancy produces different urban conditions and immediately affects the surrounding area and neighbourhood. While the relationship between office space and urban fabric can be discussed as the one that is muting the street life during night, it usually and nevertheless creates an activation of urban space during daytime. Areas in which data centers are placed, however, become drained of all public life. This phenomenon results in an urban condition in which one is facing culturally empty and program-less areas.

Throughout history, trade was the accelerant for human settlements and urban developments, closely related to the spaces used. Today, electronic trade has replaced most other forms of trading and has become an accelerant for the development of new types of urban and spatial infrastructures. Examples of virtual trade in the 2010's would be Amazon.com[xii] with its super-size warehouses or Silk Road[xiii], the online black market, with its own encryptions, Tor's and bitcoins. (fig.3)

As the user interface decreases in physical size, the size of the network is rapidly growing and is in desperate need of more physical datums. The number of data centres in the world in 2011 reached over 500,000 with 26,4 million square meters of space or the size of around 6,000 football fields[xiv]. A closer look at network infrastructure reveals that energy consumption of data centres worldwide in 2009 was bigger than the amount of energy the whole of Sweden[xv] consumed with its 450,295 square kilometres of territory and a population of 9.5 million. Likewise, exchange of data in the virtual realm means producing energy in the physical space.

The server is at the moment the most precious object, just as once, different kinds of currencies were the most precious objects of exchange. Servers store all our emails, attachments, transactions and Internet knowledge in multiple physical locations, that we are mostly not aware of. Banks are no longer the most secured spaces, keeping money and gold safe. Data centres and their high levels of security became physically the safest places on the planet. If money is not physical anymore, then it is definitely encapsulated in the Network infrastructure, and to imagine a World without money might be imagining the world with even more data centers and endless miles of cables that connect them. In the world ruled by banks and petrocurrency[xvi], could the server become the currency of the 21st century?

'Being Online: the infrastructure of money' is a continuation of the Master Thesis Project 'Latencity.a guide book to infrastructure and the social city' at the Städelschule Architecture Class in 2013.

[i] Blum, Andrew, 'Mapping the Internet: Financial hubs', CnnMoney ,16 Jul 2012, ,

Accessed: 15 Mar 2013. < http://tech.fortune.cnn.com/2012/07/16/chartist-internet-financial-hubs/>

[ii] Infrastructure, on Merriam webster online dictionary Accessed 19 Jan 2014

<http://www.merriam-webster.com/dictionary/infrastructure>

[iii] Rapp, Nicolas, Mapping the internet 09 Jul 2012. nicolasrapp.com Accessed: 10 Jan 2014. <http://nicolasrapp.com/?p=1180>

'The majority of transatlantic undersea cables land in downtown Manhattan wherethe result has been the creation of a parallel Wall Street geography, based not on the location of bustlingtrading floors but on proximity to the darkened buildings that house today’s automated trading platforms.The surrounding space is at a premium, as companies strive to literally shorten the wire that connects themto the hubs.'

[iv] Mau, Bruce, 'Getting Engaged', in Anytime- Anyone Corporation', the MIT Press, Cambridge

Massachusetts, London, England 1999, p.202

[v] Meier-Hahn, Uta, Internet Exchange Points Are to Speed Up Internet Development 29 Nov 2012 TheAlexander von Humbolt Institute for Internet and Society, Accessed: 01 Mar 2013.

<http://www.hiig.de/en/internet-exchange-points-are-to-speed-up-internet-development/>

'At the biggest German Internet Exchange Point in Frankfurt am Main more than 480 parties cooperate

with each other this way. Internet Service Providers like 1&1 or Deutsche Telekom exchange data with

content providers like Facebook, Microsoft or Akamai. Thus, the Windows update received by a German user most likely is not being transferred from the company’s head office in Redmond but from a data center in Germany.'

[vi] 17 Blum, Andrew, "Mapping the Internet: Financial hubs" 16 Jul 2012, CnnMoney, Accessed: 15 Jan 2014. <http://tech.fortune.cnn.com/2012/07/16/chartist-internet-financial-hubs/>

[vii] Summel, Robert and Varnelis, Kazys, 'Ether', in Blue Monday AUDCActar Barcelona 2007

[x] Colocation centre, Wikipedia Accessed 11 Jan 2014 <http://en.wikipedia.org/wiki/Colocation_centre>

'A colocation centre or colocation center (also spelled co-location, collocation, colo, or coloc) is a type of data centre where equipment, space, and bandwidth are available for rental to retail customers. Colocation facilities provide space, power, cooling, and physical security for the server, storage, and networking equipment of other firms—and connect them to a variety of telecommunications and network service providers—with a minimum of cost and complexity.'

[xi] Blum, Andrew, 'Mapping the Internet: Financial hubs', CnnMoney ,16 Jul 2012, ,

Accessed: 15 Mar 2013. < http://tech.fortune.cnn.com/2012/07/16/chartist-internet-financial-hubs/>

[xii] Cadwalldr, Carole, 'I Spent A Week Working At An Amazon Warehouse And It Is Hard, Physical Work', The Guardian, 01 Dec 2013. Accessed: 02 Feb 2014 < http://www.businessinsider.com/i-spent-a-week-working-at-an-amazon-warehouse-and-it-is-hard-physical-work-2013-12>

[xiii] Silk Road(marketplace), Wikipedia Accessed: 11 Jan 2014 <http://en.wikipedia.org/wiki/Silk_Road_(marketplace)>

[xiv] Miller, Rich, 'How Many Data Centers? Emerson Says 500,000' Data Center Knowledge Accessed: 11 Jan 2014 <http://www.datacenterknowledge.com/archives/2011/12/14/how-many-data-centers-emerson-says-500000/>

[xv]Vanderbildt, Tom, 'Data Center Overload', New York Times,8 June 2009 Accessed: 18 Mar 2013.

<http://www.nytimes.com/2009/06/14/magazine/14search-t.html?_r=2&pagewanted=all&>

Društvo

Društvo Društvo

Društvo